The Board of Supervisors Budget Policy Committee held a joint meeting with the School Board on Nov. 22, 2022, for the Presentation of the Joint County and Schools FY 2024 Fiscal Forecast. According to current information with projections based on the current tax rates of $1.11 per $100 of assessed value, Fairfax County staff predict FY 2024 revenue to increase by only $264 million. The preliminary result is a budgetary shortfall of $81.2 million for the County and a $43.8 million shortfall for Fairfax County Public Schools.

Christina Jackson, Fairfax County chief financial officer, and Leigh Burden, FCPS assistant superintendent, Financial Services, presented to the supervisors and school board representatives; Bryan Hill, county executive; Dr. Michelle C. Reid, Schools Superintendent; and Marty Smith, FCPS chief operating officer, and others. The Fairfax County budget is the largest municipal budget in Virginia and is larger than the budgets of some states.

Last May, the Fairfax County Board of Supervisors adopted a $4.8 billion budget for FY 2023. The board lowered the county’s tax rate for homes from $1.14 to $1.11 per $100 of assessed value. However, homeowners paid an average of $465 more per year.

“We’re still really early in the process,” Jackson said. “(Projections are) subject to change as we take into consideration the impact on our homeowners and our residents as we go through this budget process.”

Jackson noted that everyone is aware of the high levels of inflation, the real estate market is rapidly changing, and the county anticipates that there could be further softening of the market in the next couple of months.

The focus will be on employee salaries as recruitment and retention issues remain, Jackson said. There is limited flexibility for other priorities, and important items are not included in the forecast because of “significant revenue constraints.”

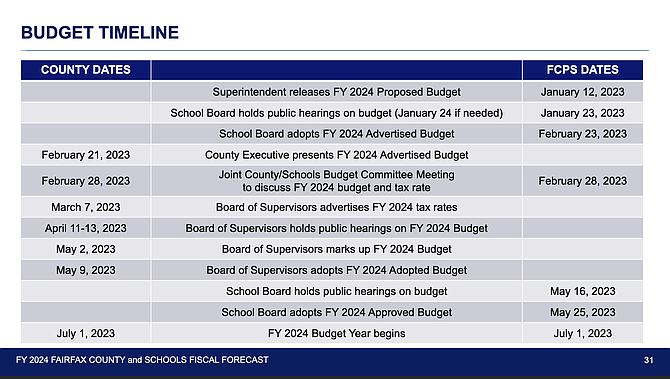

The FCPS Superintendent’s Budget Releases on Jan. 12, 2023, and the County Executive’s Advertised Budget Release is on February 21, 2023.

Economic Outlook and Revenue Projections

With an uncertain economic outlook, staff conservatively approached the FY 2024 revenue forecasting, Jackson said.

Inflation rates above 8 percent, rising mortgage interest rates above 7 percent which impact the real estate market, disruptions in the energy supply, a persistently tight labor market, and declining consumer confidence are among the challenges.

Real estate tax revenue is the most significant component of General Fund revenue, comprising more than 67 percent. Jackson noted that the number of home sales in October was down 22.1 percent in the county.

The budget timeline for January and February 2023 has the superintendent releasing the FY 2024 Proposed Budget on Jan. 12; the school board holds a public hearing on Jan. 23 and Jan. 24 if needed. On Feb. 23, the School Board adopts the FY 2024 Advertised Budget.

On Feb. 21, the county executive will present the FY 2024 Advertised Budget; on Feb. 28, there will be a Joint County/Schools Budget Committee Meeting to discuss the FY 2024 County and Schools Advertised Budgets and tax rate.

Additional meetings occur March-May leading to when the Board of Supervisors adopts the FY 2024 Adopted Budget on May 9, and the School Board adopts the FY 2024 Approved Budget on May 25. The FY 2024 Budget Year begins July 1, 2023.